Welcome to Kompass

A Venture Capital Firm Dedicated To Your Success

Founded in 2020, Kompass operates a narrow investment thesis focused on technologies developed towards solving problems unique to black and brown communities in America. Our philosophy has been both black and brown founders withhold stories and backgrounds that position them mature for investment and validation with an eye towards long term growth and profitability.

Vision

At Kompass, our focus is on helping founders design, modify, and measure the company’s framework with an eye toward long-term profitability and expansion. Starting a company takes considerable investment in time and capital, and most new founders of color are limited by their professional networks to shape their journey. The Kompass vision entails establishing a management, product, and operational infrastructure to support firm objectives. The result and benefit mean deploying business solutions that meet customer needs while achieving revenue and profitability goals.

Mission

Our mission is to unlock and open reliable, committed, and sensitive doors to the broader community of African American startups for the real purpose and pursuit of establishing economic autonomy and agency in black and brown communities.

The Why

In a February 2023 Pew Center research report, African Americans accounted for only 3% of all U.S. firms that were classifiable by the race and ethnicity of their owners in 2020. And Black-owned firms accounted for just 1% of gross revenue from classifiable companies that year. Statically, Black adults are more likely to be unemployed and Black businesses are more likely to hire Black workers, so the shortage in Black businesses chokes employment and development in Black communities, moreover underrepresentation of Black business costs U.S. GDP a loss of billions of dollars in unrealized gains. At Kompass, our why involves empowering the entrepreneurs of HBCU alumni through investment that extends beyond writing a check, but setting in motion an economic virtuous cycle grounded in Black American supply and demand.

Why Choose Us

An investor shows your company has promise. A considerable amount of your agreement with an investor is their guarantee on their return on investment (ROI). Ultimately, a business owner and an investor have the same mission. An investor’s goal is backing a successful brand or promising startup. In a competitive business network, startup funding can be difficult to secure. Your business won’t meet its strategic goals without the proper funding. Finding the right investor to partner with can also take substantial outreach.

Kompass reaches out to aspiring startup professionals with adequate funding that allows them to get their company up and operational. With the right investor backing your business endeavors, you can pioneer your niche area of commerce. When you’re ready to excel with your startup or as an entrepreneur, securing the right investor is the key to your success.

Meet The Team

The investment and business operations teams include an impressive 25 years of experience starting, managing, investing, and exiting firms across the technology, hospitality, consumer products, and retail industries.

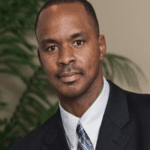

Ronald Jones

Managing Partner

Paula Arango

Managing Partner

Niles Dillard

Advisor

N/A